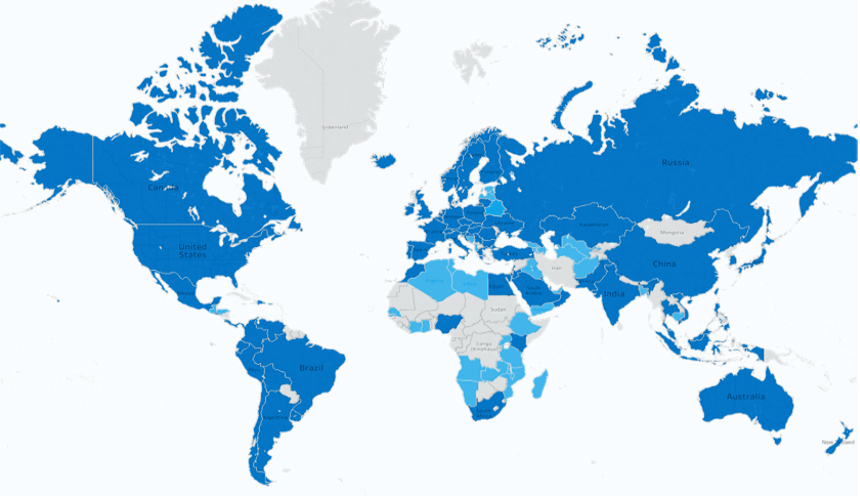

IRON enables global organizations to focus on their core business, not managing complexities associated with import of IT products. It offers easy options to purchase IT products from any country-of-origin and deliver door-to-door to the destination country in shortest possible time. IRON eliminates hassles associated with freight management, import customs clearance, inspections, taxes and compliances.

Service Global IOR

IRON Service Global IOR™ Import services solution helps international buyers and sellers by providing them with a single, Turn-key, Import solution to fulfill everything needed to purchase and sell IT products

- Customs Authorities & Trade Compliance Pre-Approvals: IRON works with customs agencies in each country, in advance, to identify and secure all required licenses and permits.

- Sellers: IRON works with manufacturers and sellers of IT products to form a simplified export/import program globally; Products are pre-approved for shipment to 90+ countries. IRON prepares shipping documents and assists in door-to-door delivery and final POD confirmations.

- Buyers: IRON works with buyer in the destination countries and helps streamline the buying experience. Buyers can be assured that IRON will meet local trade compliances, manage logistics & customs, and deliver product to their premises with defined SLAs.

Importer Of Recods (IOR) Representation

Importer Of Recods (IOR) Representation VAT & Duties Payments

VAT & Duties Payments Local Frights & Proof of Delivery

Local Frights & Proof of Delivery Export & import Compliance

Export & import Compliance Global Export & Reserve Logistics

Global Export & Reserve Logistics Customs Brokerage

Customs Brokerage

Turnkey Global Import Logistics Services Program

Provides Global Forward Freight Logistics Services

IRON serves as your freight logistics expert and manages shipment from point of pickup at the seller, and delivery to the business premises in the country where sold are delivered.

IRON Provides Global Customs Brokerage Services

IRON acts as your Customs Clearance agent for preparation of import entry document filing, deposit of import duties and taxes on your behalf, secure release of goods from customs and arrangement for local delivery after customs clearance.

IRON Manages Import Tax Billing and Post-Payment Collection Services

Following the delivery of product to your premises, IRON will bill Buyer for (a) Fixed, IRON provided Services Global IOR Fee inclusive of freight logistics, customs brokerage and IOR services, and (b) Variable, adjusted to actual Import Duties or/and Taxes paid for customs clearance. These services can be paid to IRON Global via Credit Card or Wire Transfer.

IRON Managed Tax Deferment & Reclaim Management Services (EU Only)

IRON delivers products to EU buyers under VAT deferment program. Buyers are only billed for (a) IRON provided Service Global IOR Fee. Further, IRON provides buyers with all required assistance to reclaim VAT without an actual cash transaction.

IRON Provides Importer of Record (IOR) Fiscal Representation and Import Taxes Pre-Payment Services

IRON serves as your local Importer and acts as the Consignee of the import shipment. IRON ensures that imports comply with local laws & regulations, customs documents and tax declaration. IRON can pre-pay all of the assessed Import Duties and Taxes on your behalf at the arrival airport to expedite delivery. The products are delivered as DDP (Delivered Duties Prepaid).